Nobel Laureate Thomas J. Sargent

Next-generation macroeconomic models require high-performance computing: enter Julia

It’s simple: Speed + Performance + Scalability + Ease of Use

Aviva, one of the world’s largest insurers, is using Julia to comply with the European Union’s Solvency II regime. Aviva reports speed increases from 20x up to 1000x faster compared to their legacy system. Furthermore, Aviva reduced the code for compliance models from 14,000 lines of code in a proprietary legacy system to just 1,000 lines of code in Julia. This doesn’t just increase speed, efficiency and productivity - it also reduces errors and time spent checking and debugging code.

BlackRock, the world’s largest asset manager, uses Julia to power their trademark Aladdin platform.

State Street uses Julia to identify best execution for foreign exchange trading. Conning uses Julia in large scale Monte Carlo simulations for insurance risk assessment.

Other banking, finance and economics users include Atteson Research, the Federal Reserve Bank of New York, Berkery Noyes, Nobel Laureate Thomas J. Sargent, Timeline and Now-Casting Economics.

Watch our webinar to see how to improve the process with JuliaHub.

Julia is the fastest language for finance, including Monte Carlo simulations, dynamic modeling, algorithmic trading and risk analysis.

Accomplish more with fewer lines of code - spend less time coding, editing and debugging.

Private package development allows users to develop and secure their own competitive edge.

JuliaInXL, Miletus, Bloomberg integration - Julia has the best packages for seamless, integrated financial modeling, analytics, developing and executing trading strategies.

Julia works with GPUs, TPUs, supercomputers and other high performance computing environments.

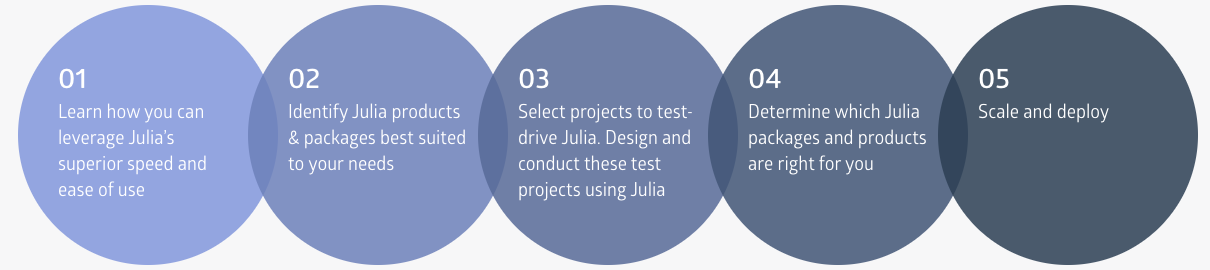

Learn about our products and how you can leverage AI

Implement our solution at your preferred pace

Experiment with a new project in Pumas & Julia

Educate your team through scheduled training

Scale your results in the cloud with JuliaHub

Next-generation macroeconomic models require high-performance computing: enter Julia

Conning is using Julia in large scale Monte Carlo simulations for insurance risk assessment solutions

Learn how JuliaHub can help your organization. Request a demo now.

WEBINAR

WEBINAR

WEBINAR